The Global FM Impact Report 2023

A critical review

The facility management industry is crucial in assisting the built environment in making it a better place. In recent years, the global FM market has experienced significant growth, driven by factors such as technological advancements, regulatory requirements and an increasing focus on sustainability.

Understandably, COVID-19 had a colossal impact on the FM industry, which led organizations to re-focus their entire business operations. The COVID-19 pandemic not only underscored the importance of health and safety, evolving regulations, and compliance in FM, but it also provided a new wave of thinking regarding working patterns and preferences, prompting organizations to rethink space utilization and adapt to remote and hybrid work environments.

In turn, the importance of technology integration and digital transformation (DT) is at the foundation of future growth. COVID-19 has accelerated the adoption of technology-driven solutions in FM, as a means of organizations overcoming the disruption of global supply chains, talent shortages, and mitigating financial pressures.

IFMA published a seminal white paper in 2023 “Leading the Digital Transformation in the Facility Management Industry,” describing the critical trends shaping the business community concerning DT and how DT impacts knowledge and skills development. It cautioned how organizations expect FM teams to support or lead organization-wide specific DT efforts, which proves a challenge for many. DT impacts buildings’ role in value creation, affecting how FM companies organize operations and serve core organizations and end users. It emphasizes that end users expect digitally enabled, individualized, quick and efficient services — expectations which FM organizations must mobilize and align to fast.

This change also brings risk, to which facility managers are key in safeguarding smart buildings and occupants from digital threats. FMs must adapt to understanding the susceptibility to cyberattacks on the operational technology (OT) that they are responsible for, with organizations often siloing OT, IT, and physical security, hindering collaboration and coordination.

Global FM

Global FM is a worldwide alliance of FM Associations, representing a collaborative network of industry professionals, practitioners, and stakeholders dedicated to advancing the FM profession globally. The organization serves as a platform for knowledge sharing, best practice dissemination, and advocacy for the FM industry. Global FM fosters international cooperation and collaboration among its member organizations, which include leading FM associations from different regions around the world, such as IFMA and the Institute of Workplace and Facilities Management (IWFM).

Global FM’s flagship output is the “Global FM Impact Report” which helps global regions, countries and sectors better understand the significance of FM on the wider economy, employment, and society. The report, produced by the market and research consultancy firm Frost & Sullivan, analyzes data from 58 countries, and identifies emerging trends and imperatives for the FM industry, focusing on the sustainable and transformative impacts for FM, now and in the future.

Market Size

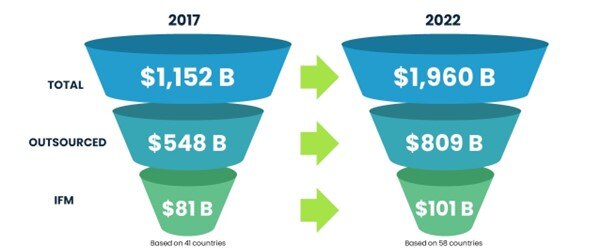

The global FM market is estimated at US$1.125 trillion and has seen a total increase in size of 70 percent between 2017-22, with outsourced services increasing by 48 percent (Figure 1). This growth is fueled by the rising demand for integrated facility management (IFM) solutions, an indication of the maturity of the FM industry, which streamlines operations and reduces costs for businesses across various sectors.

The global FM market is estimated at US$1.125 trillion and has seen a total increase in size of 70 percent between 2017-22, with outsourced services increasing by 48 percent (Figure 1). This growth is fueled by the rising demand for integrated facility management (IFM) solutions, an indication of the maturity of the FM industry, which streamlines operations and reduces costs for businesses across various sectors.

When comparing global regions (Figure 2), the report highlights that Asia Pacific (APAC) has the largest FM market size (US$525.3 billion), closely followed by North America and Europe. The smallest market size is Africa (US$23.7 billion), closely followed by the Middle East and South America.

Outsourcing capabilities

Outsourcing capabilities

Despite its small market share, the Middle East possesses the most mature FM market, represented by its low in-house provision and high IFM penetration (9 percent). When comparing the outsourcing capabilities across the global regions (Figure 3), it emphasizes the huge growth potential in the emerging regions of APAC, South America and Africa, which at present, possess a high proportion of in-house delivery, with minimal IFM penetration.

FM impact

The most exciting aspect of the report is the fact that it focuses on impact, rather than a standard market size study. This is exemplified by the inclusion of Frost & Sullivan’s analysis of the impact of digital transformation and sustainable practice in the FM industry.

Frost & Sullivan developed a methodology to appraise digital transformation and sustainable FM practice. They first identified proxy indicators and then co-relate them to the FM industry through specialist interviews and secondary data analysis. They were then able to produce their rating, on a scale of 1-5, with 1 having none or little advancement, and 5 being very advanced.

Digital transformation

Digital transformation

The level of digital maturity across global regions is relatively consistent in Europe, North America, the Middle East and APAC, with Africa and South America showing a lower level of advancement (Figure 4). South America is the least digitally mature region, with Chile being an anomaly, which appears to have the most stable economy. The report highlights that in the more mature market regions, the focus on service innovation means that merger and acquisition activity will shift from service expansion, geography and economies of scale, to acquiring technologies and new skills.

Sustainable FM practice

The level of sustainable FM practice across global regions shows a similar pattern, with Europe, North America and the Middle East being the most advanced, with APAC, Africa and South America showing a lower level of advancement. Europe is the leading region for sustainable FM practice, which is exemplified by the fact that 19 out of the top 20 ranked countries for sustainable FM practice are in this region (the outlier being Japan).The report highlights that whilst the current sustainability focus tends to be around energy, emissions and waste, the social impact and governance elements of environmental, social and governance will come more into focus moving forward.

The level of sustainable FM practice across global regions shows a similar pattern, with Europe, North America and the Middle East being the most advanced, with APAC, Africa and South America showing a lower level of advancement. Europe is the leading region for sustainable FM practice, which is exemplified by the fact that 19 out of the top 20 ranked countries for sustainable FM practice are in this region (the outlier being Japan).The report highlights that whilst the current sustainability focus tends to be around energy, emissions and waste, the social impact and governance elements of environmental, social and governance will come more into focus moving forward.

Global imperatives

In evaluating the global trends and impacts, a number of strategic imperatives were established for the FM industry (Figure 6), many of which corroborate with other reputable sources regarding emerging FM trends.

Despite the FM industry seeing a gradual rise post COVID-19, the industry dipped during the geopolitical chaos accelerated from the pandemic and has been slow to recover revenue since. It is now crucial for business to focus on organizational resilience, with leading companies playing defense on risk and also playing offense on growth, a top priority for CEOs to consider moving forward. There are mega trends around technology integration and digitalization that will transformation the FM industry, as already covered, whilst it is also worth emphasizing the importance of flexibility and mobility in the workplace and the need to rethink our approach to social sustainability. Finally, to overcome internal challenges, service providers need to produce ready-made market solutions rather than waiting for clients to tell them what they want. FM organizations are encouraged to position themselves as leaders in clients' organizational changes, rather than service providers. As such the demand for service integration (e.g., through Anything as a Service XaaS, and IT-OT integration), and value creation that maps to customer’s needs (e.g., through new ways of working).

Despite the FM industry seeing a gradual rise post COVID-19, the industry dipped during the geopolitical chaos accelerated from the pandemic and has been slow to recover revenue since. It is now crucial for business to focus on organizational resilience, with leading companies playing defense on risk and also playing offense on growth, a top priority for CEOs to consider moving forward. There are mega trends around technology integration and digitalization that will transformation the FM industry, as already covered, whilst it is also worth emphasizing the importance of flexibility and mobility in the workplace and the need to rethink our approach to social sustainability. Finally, to overcome internal challenges, service providers need to produce ready-made market solutions rather than waiting for clients to tell them what they want. FM organizations are encouraged to position themselves as leaders in clients' organizational changes, rather than service providers. As such the demand for service integration (e.g., through Anything as a Service XaaS, and IT-OT integration), and value creation that maps to customer’s needs (e.g., through new ways of working).

The Global FM Impact Report 2023 provides critical insights into the global FM market, focusing on market trends, outsourcing capabilities, digital transformation, and sustainability practices. It highlights the impact of COVID-19 on the FM industry, emphasizing the need for organizational resilience and adaptation to new business models. The report discusses the market size growth, regional disparities in outsourcing, and the importance of digital maturity and sustainability in FM practices. It also touches on the evolving trends in facility management, emphasizing the shift towards more sustainable and resilient approaches in the post-pandemic era. Overall, the document underscores the significance of embracing digital advancements and sustainability initiatives to navigate the changing landscape of the FM market effectively.

References

Integrated facility management (IFM) is defined in this instance as services provided by a single provider across at least two FM service spheres: one provider at least two FM service spheres: operations and maintenance, energy management, support services, built environment management, and data and technology.

Examples of proxy indicators were the IMD Digital Competitiveness Index 2021 and the Global Sustainability Index 2021

IFMA, “Leading Digital Transformation in the Facilities Management Industry,” 2023. ifma.foleon.com/white-paper/digital-transformation

IFMA, “The Convergence: Managing Digital Risk and FM's Role in Protecting Digitizing Buildings,” 2023. ifma.foleon.com/white-paper/cybersecurity

Global FM, “Our Story,” globalfm.org.

Global FM, “Global Facilities Management Impact Report,” globalfm.org, 2023.

IFMA, “Evolution is Never Finished: Insights from IFMA’s Emerging Topics Working Group on How Six Key Topics are Transforming the FM Industry,” 2023. ifma.org/resources/research-benchmarking

IFMA, “Seeking Higher Ground: Navigating the FM Industry’s Transformation,” 2022. ifma.foleon.com/white-paper/seeking-higher-ground/.

McKinsey & Company, “What matters most? Six priorities for CEOs in turbulent times,” 2023. mckinsey.com/featured-insights/mckinsey-live/webinars/what-matters-most-six-priorities-for-ceos-in-turbulent-times.

Read more on Leadership & Strategy , Research & Benchmarking and Emerging Topics

Explore All FMJ Topics